China’s stimulus bazooka: what does it mean for gold demand?

22 October, 2024

Summary

- China has recently announced aggressive stimuli to shore up consumer confidence and support growth

- Based on our models we believe the potential improvement in GDP will benefit gold demand in China

- However, gold investment appetite may face competition from other assets including equities and property as the economy recovers.

China’s stimulus bazooka

China shocked the world with the announcement of its recent and most aggressive stimuli since COVID, designed to support the economy and boost household confidence. The long-awaited and stronger-than-expected package, announced by the People’s Bank of China (PBoC), ranges from various rate cuts and downpayment ratio reductions to measures that will support the equity market.1

And on top of all this, China has recently announced additional fiscal policy support, including increased special government debt issuance to help low-income households and enhance state-owned commercial bank capital, as well as support that will help local government resolve hidden debt issues.2 New measures to further revive the housing market including another loan prime rate cut were also announced most recently. 3

Equity market sentiment improved

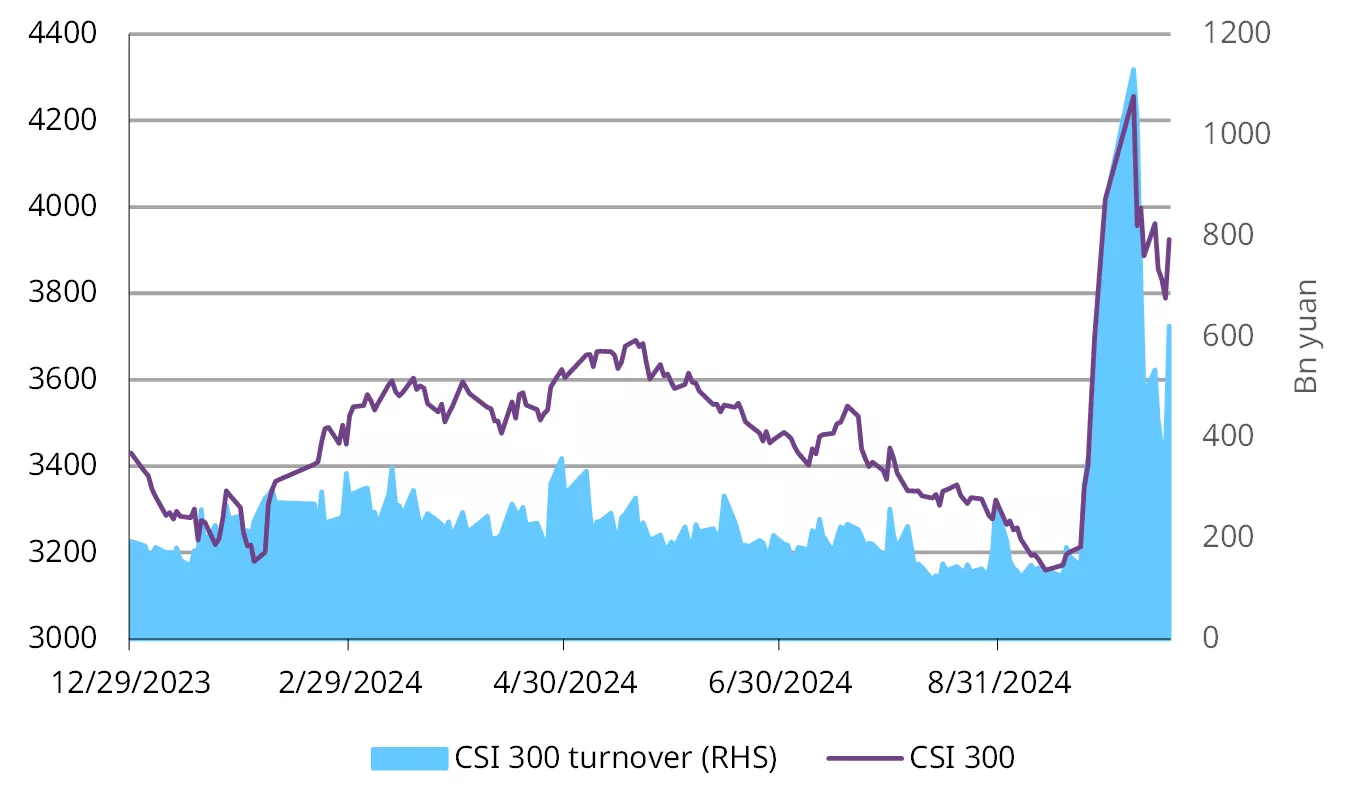

Stocks cheered in response (Chart 1). The CSI300 Stock Index jumped by 16% when the stimuli were announced in the last week of September – its strongest weekly performance since November 2008. Meanwhile, Chinese equities attracted net inflows of 252bn yuan, the largest weekly volume on record.4 And while market volatility rose sharply following the early October National Day Holiday, trading volumes and investor sentiment towards Chinese equities generally stayed elevated.

Chart 1: Despite recent volatility, investors are generally in a cheerful mood

China’s Shenzhen and Shanghai 300 Stock Index and daily turnover*

*As of 18 October 2024.

Source: Bloomberg, World Gold Council

What does this mean for gold demand in China?

The recent measures are likely to provide support for China’s economic growth. A reduced mortgage burden along with various other measures designed to revive the property sector could boost consumer and investor confidence. This is borne out by the fact that institutions have raised their expectations for China’s GDP growth in 2024.5

The anticipated rebound in economic growth will likely boost China’s gold demand. And as the largest components of that demand, we believe gold jewellery and bar and coin will be impacted the most (Chart 2).

Chart 2: Gold jewellery and bullion investment drive Chinese retail gold demand

Gold demand composition in 2023 and the 10-year average*

*10-year average based on the average between 2014 and 2023. Note that gold jewellery demand figures are net of recycling, assuming all recycling supply comes from the jewellery sector.

Source: Metals Focus, World Gold Council

We have noted in previous reports that China’s gold demand has been under pressure. In fact, gold withdrawals from the Shanghai Gold Exchange (SGE) – a proxy of China’s wholesale demand – have remained well below their long-term average (Chart 3). While the surging gold price has helped sustain some investment buying, it has hampered gold jewellery consumption. And the pessimistic outlook for China’s economy has also limited household spending on gold.

Chart 3: 2024 Chinese gold demand is below its long-term average

Monthly gold withdrawals from the SGE and the 10-year average

Source: Shanghai Gold Exchange, World Gold Council

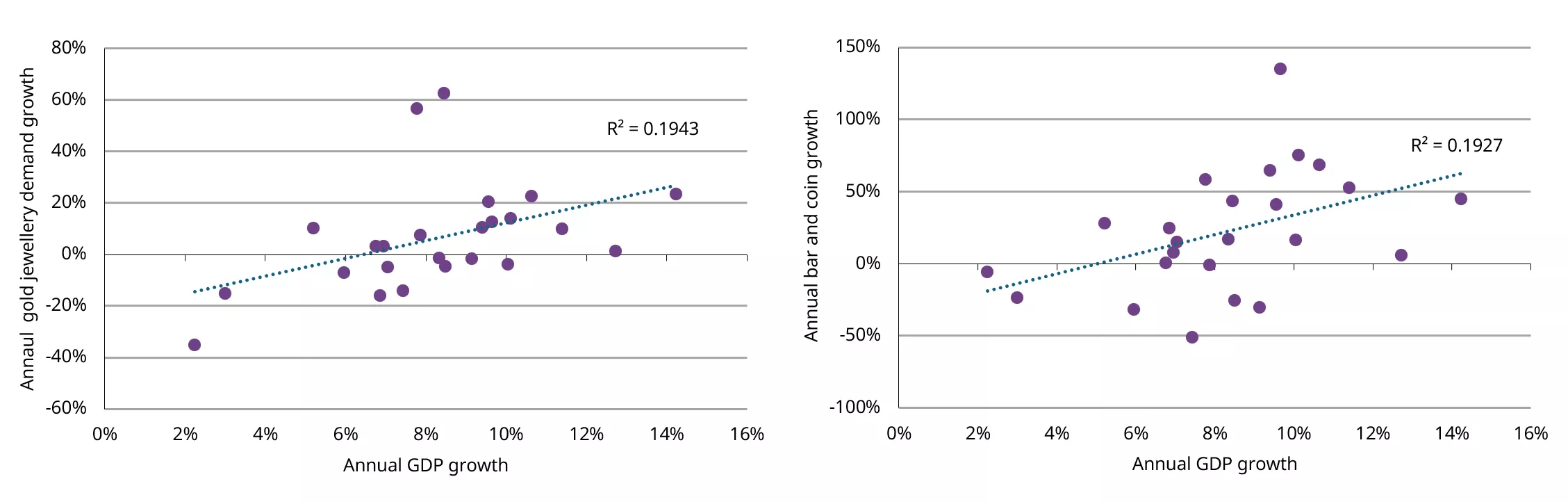

But the aggressive stimuli should provide tailwinds. Our analysis shows that economic growth is the fundamental driver of Chinese gold demand (Chart 4). More specifically, every one percentage point increase in China’s annual GDP growth leads to a 5.2% rise in gold jewellery consumption and a similar 5.1% increase in bar and coin buying, holding all else constant.

Chart 4: In general, good economic news = good gold consumption news

Annual GDP growth and annual growth in gold jewellery demand (left) & bar and coin investment (right)*

*Based on annual Chinese gold jewellery demand, bar and coin investment and GDP between 2000 and 2023.

Source: Metals Focus, Bloomberg, Shanghai Gold Exchange, World Gold Council

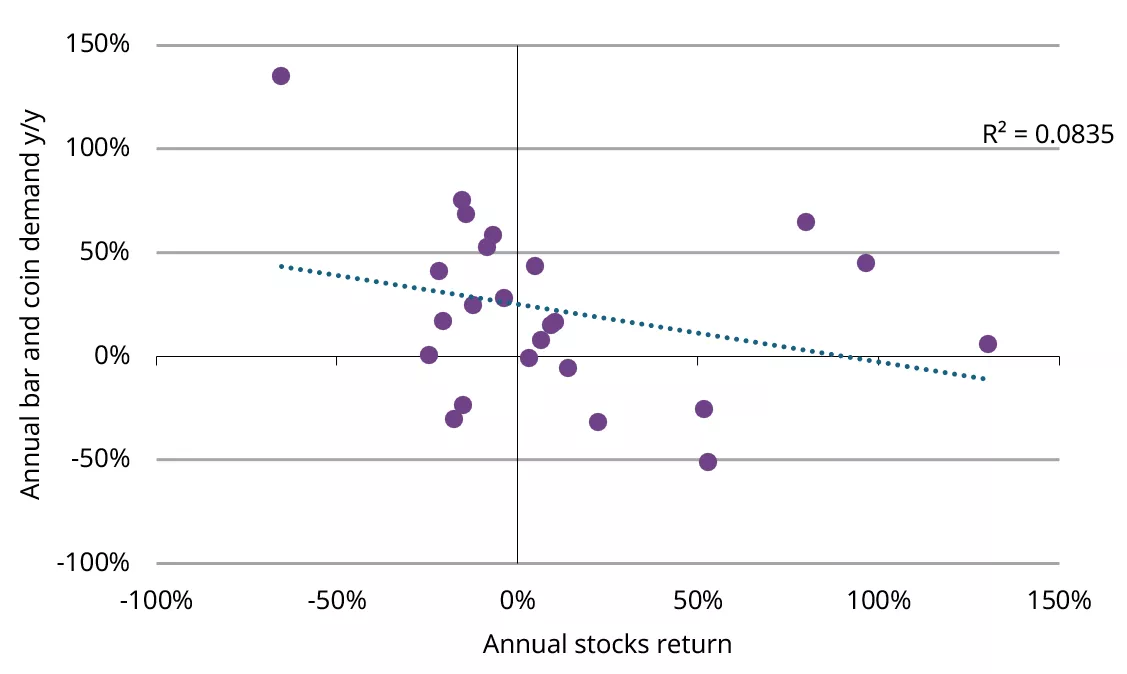

But there are other considerations. The level of the local gold price and the number of weddings are other main factors that impact gold jewellery consumption. Also, our analysis shows that, other than GDP, every 1% increase in the value of local equities reduces gold investment demand by 0.4% as enhanced investor risk appetite tends to limit safe-haven demand for gold (Chart 5). Finally, while limited historical data limits our ability to quantify the effect for gold ETFs, we anticipate investment in this sector may also face competition from equities and other risk assets – and the gold price will continue to be a key factor impacting gold ETF flows in China.

Chart 5: Usually, strong equity performance distracts investors from bar and coin investment

Annual stock returns and bar and coin demand change*

*Based on annual changes in bar and coin as well as Shanghai Composite Stock Index between 2000 and 2023.

Source: Wind, Metals Focus, World Gold Council

Summary

Although it may take some time for the economy to fully digest the positive impact of the current and potential future stimuli, we believe improved consumer confidence and GDP growth should bode well for China’s gold demand in general.

That said, other factors such as the gold price, the number of weddings, changes in young consumers’ tastes, as well as the industry’s consolidation – as mentioned in our recently published 2024 Chinese Gold Jewellery Retail Insights – are also vital drivers of local gold jewellery demand.

Furthermore, as investors perceive a brighter economic future and competing assets, such as property, come into focus, the needle for bar and coin investment is also likely to shift.

Gold has been a fascinating accessory, a proven store of value and long treated as the symbol of good luck to China. And we believe its relevance in Chinese consumers’ daily lives as well as in local investors’ portfolios will continue to shine. We will keep a close eye on future developments and provide more detailed analysis as needed.

Footnotes

1. For more, see: China's central bank unveils sweeping measures to boost economy - CGTN and China unveils fresh stimulus to boost high-quality economic development (www.gov.cn)

2. For more, see: China to launch more fiscal stimulus measures, says finance ministry - CGTN and China economy: Beijing will ‘significantly’ increase spending | CNN Business

3. For more, see: China unveils new measures to stabilize housing market (www.gov.cn) and China cuts benchmark lending rates by 25 basis points

4. Based on Wind’s statistics. This data goes back to January 2010 on a daily basis.

5. For more, see: Goldman Sachs raises China's economic growth forecast - CGTN