India’s gold market update: Anticipating a festive boost

21 October, 2024

Highlights:

- The surge in demand from the import duty cut was tempered by fresh record-high prices and an inauspicious period in September according to the Hindu calendar

- Domestic gold prices are currently at a slight discount over landed cost1 amid normalising demand

- However, signs of festive buying are beginning to emerge

- With an addition of 54.7t y-t-d,2 the Reserve Bank of India’s (RBI) gold reserves have grown by 7%

- Increased interest in Indian gold ETFs; inflow momentum remains strong

- Gold imports see moderation in imports after August surge.

Looking ahead:

- Anticipation of festive demand; rural purchases expected to provide support.

Gold prices stay elevated after touching record highs

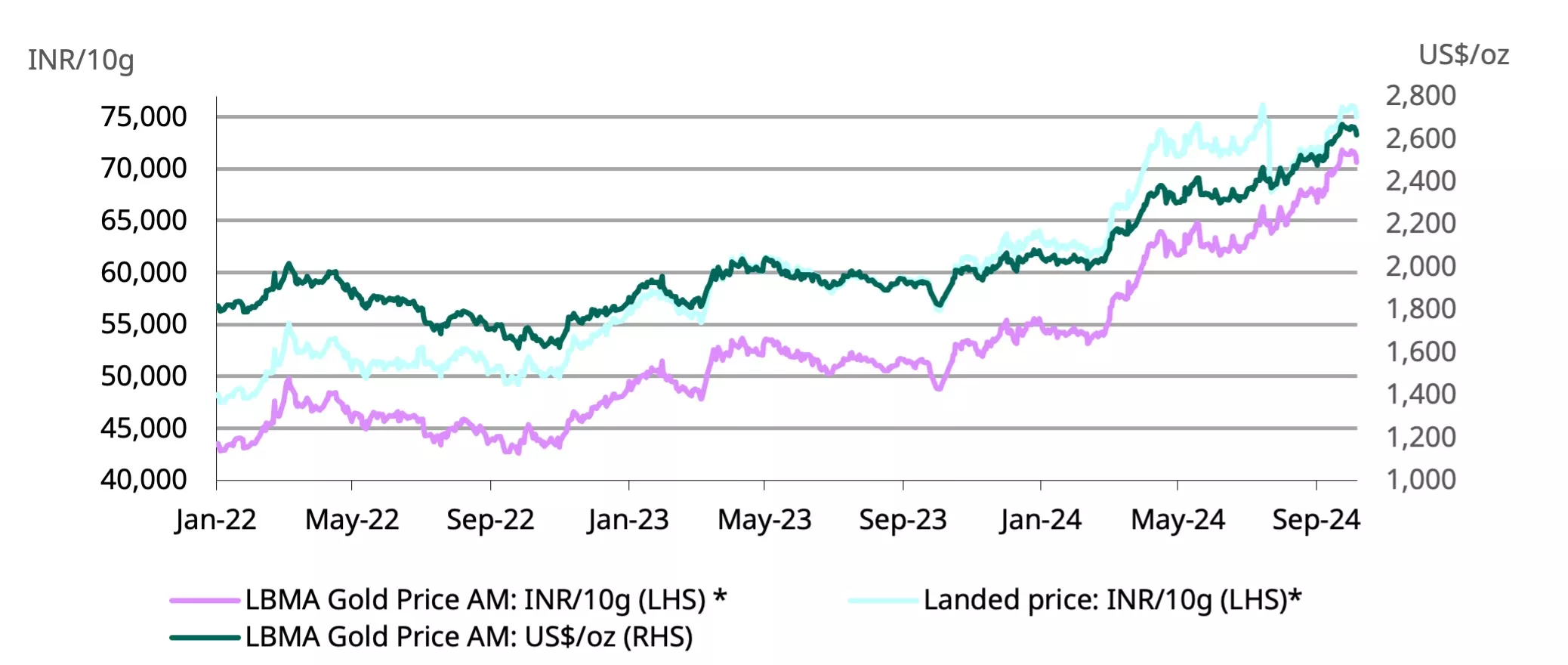

Gold prices continued to rise in September, building on the strong gains from July and August, and reaching multiple new highs. By the end of September, international prices had increased by 5% to US$2,650/oz,3 bringing year-to-date gains to 28%. Domestic landed prices mirrored this trend for the month, surpassing pre-import duty cut levels to INR 75,549/10g,4 aided by the relative stability of the INR against the USD.

The price increases were primarily driven by a decline in the US dollar, as the Federal Reserve initiated monetary policy easing with a significant 50bps interest rate cut. Additionally, ongoing geopolitical tensions contributed to the price rally. While prices have slightly moderated by 1% in October, they remain elevated, with y-t-d international price increases at 27% at the time of writing.

Chart 1: Gold price sees sharp gains

LBMA Price AM and domestic landed price by month, US$ and INR*

*Based on the LBMA Gold Price AM in USD expressed in local currency as of 9 October 2024. Landed price includes import tariff and tax.

Source: Bloomberg, World Gold Council

Festive buying to support demand: high prices a challenge

High prices coupled with an inauspicious period in the Hindu calendar for making purchases of valuable items from mid-September to early October, kept consumers away from jewellery buying. However, market reports indicate early signs of a resurgence in gold buying due to various ongoing festivals, with demand largely driven by wedding purchases. Retailers are actively implementing marketing campaigns to stimulate sales.

The surge in demand following the import duty cut, which coincided with some festivals, has been tempered by record-high prices. There is an expectation of increased demand from rural areas, driven by improvements in overall consumption. Favourable monsoons and higher crop sowing this year are anticipated to boost rural incomes, potentially leading to higher gold purchases.

Investment demand for gold bars and coins remains strong, in part fuelled by the rise in gold prices and expectations of further increases. This trend is further enhanced by sales across online marketplaces,5 making gold more accessible.

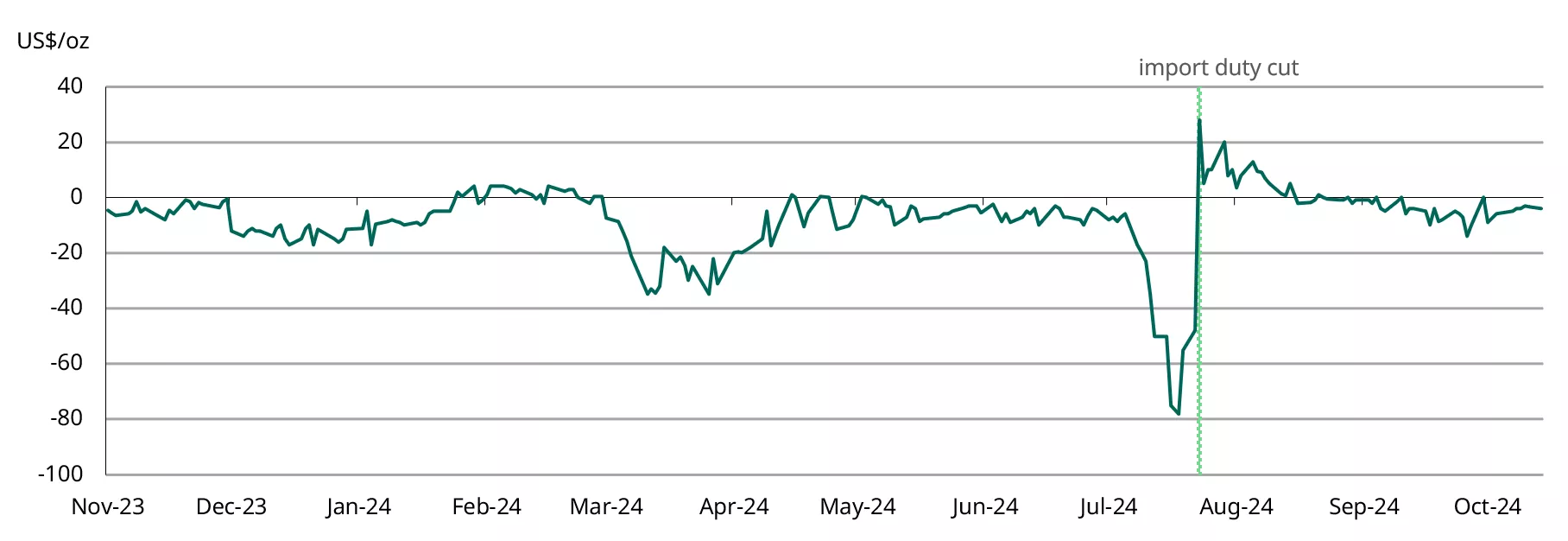

Domestic gold price trading at a modest discount

Gold prices in the domestic market are trading at a slight discount to the landed price since mid-August. This trend reflects a normalization in demand after the initial surge following the reduction in import duty. Currently, the discounts average US$4/oz, a shift from the premium6 of US$5-$28/oz that was observed for approximately three weeks post-duty cut.

Chart 2: Domestic gold prices trade at marginal discount

NCDEX gold premium/discount relative to international price*

*As of 14 October 2024.

Source: NCDEX, World Gold Council

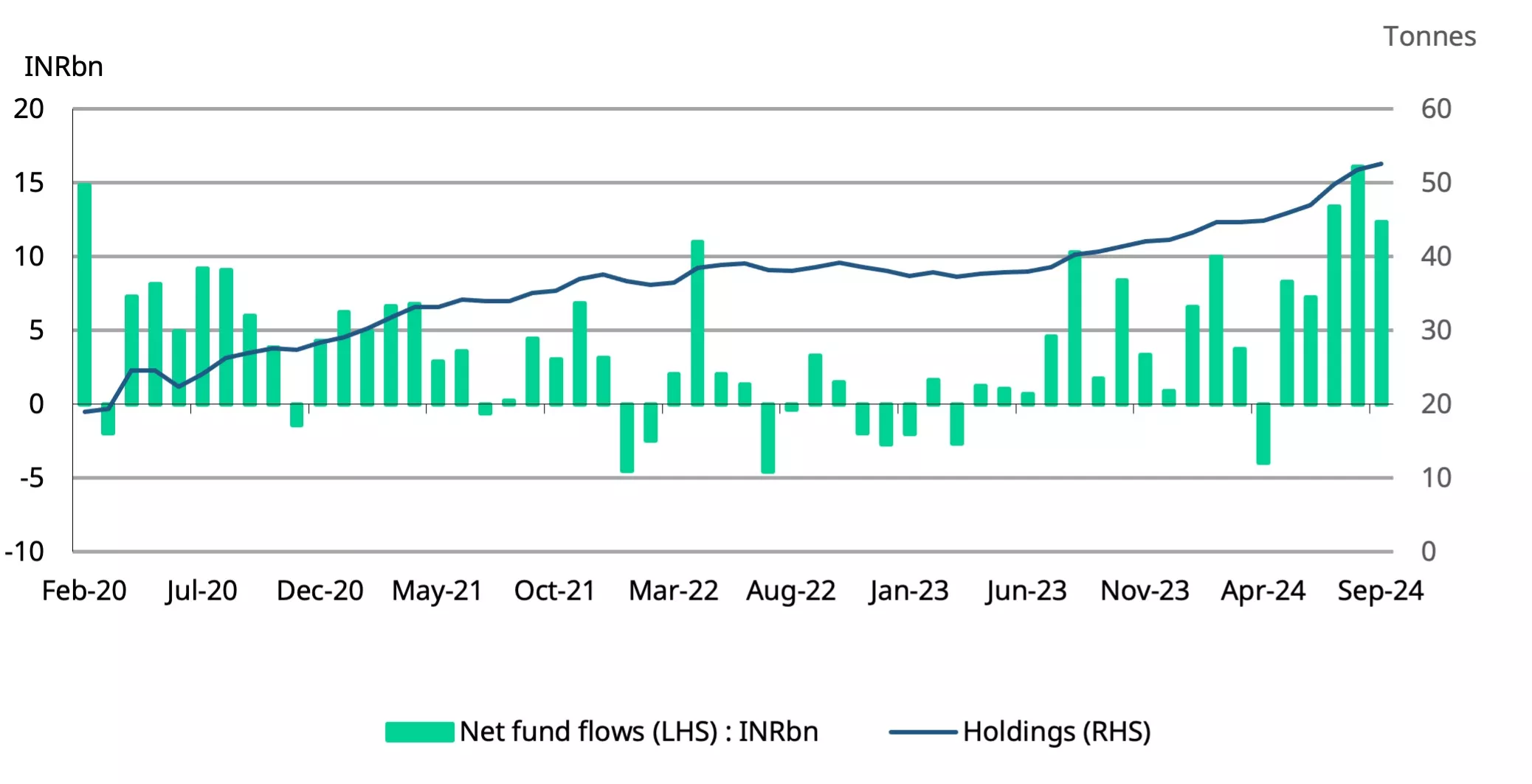

Significant growth in Indian gold ETF investments

Investor interest in Indian gold ETFs has remained strong since the taxation changes announced in the Union Budget in July, as evidenced by the notably higher inflows during this period. The strong gold price momentum and elevated geopolitical risk also contributed to inflows from investors seeking, higher returns. Anecdotal reports indicate an increase in retail investor participation. Our initial estimates based on partial information pointed to another positive month for Indian funds. And according to the Association of Mutual Funds in India (AMFI), September saw net inflows of INR12bn (~US$147mn), lower than the previous months record inflows (by 20%) but significantly higher than the average net inflows of INR 5.3bn (~US$63mn) in the first half of the year.

These sustained inflows and higher gold prices pushed up the cumulative assets under management (AUM) for Indian gold ETFs to a record INR398bn(~US$4.7bn), a 7% increase m/m and a 67% rise from a year ago, as per AMFI data. So far in 2024,7 net inflows into Indian gold ETFs have amounted to INR74bn(~US$879mn), a substantial increase from INR17bn in the same period last year. Collectively, these funds have added 10.3t of gold this year, bringing their total gold holdings to 52.6t, which represents a 29% y/y increase.

The steady inflow into Indian gold ETFs aligns with the global trend of ongoing investments in gold ETFs, driven by lower opportunity cost associated with interest rates and the US dollar, surging gold price, and demand for safe-haven assets.

Chart 3: Healthy demand for Indian gold ETFs

Monthly gold ETF fund flows in INRbn and total holdings in tonnes*

*As of end September 2024.

Source: Bloomberg, company filings, AMFI, CMIE, World Gold Council

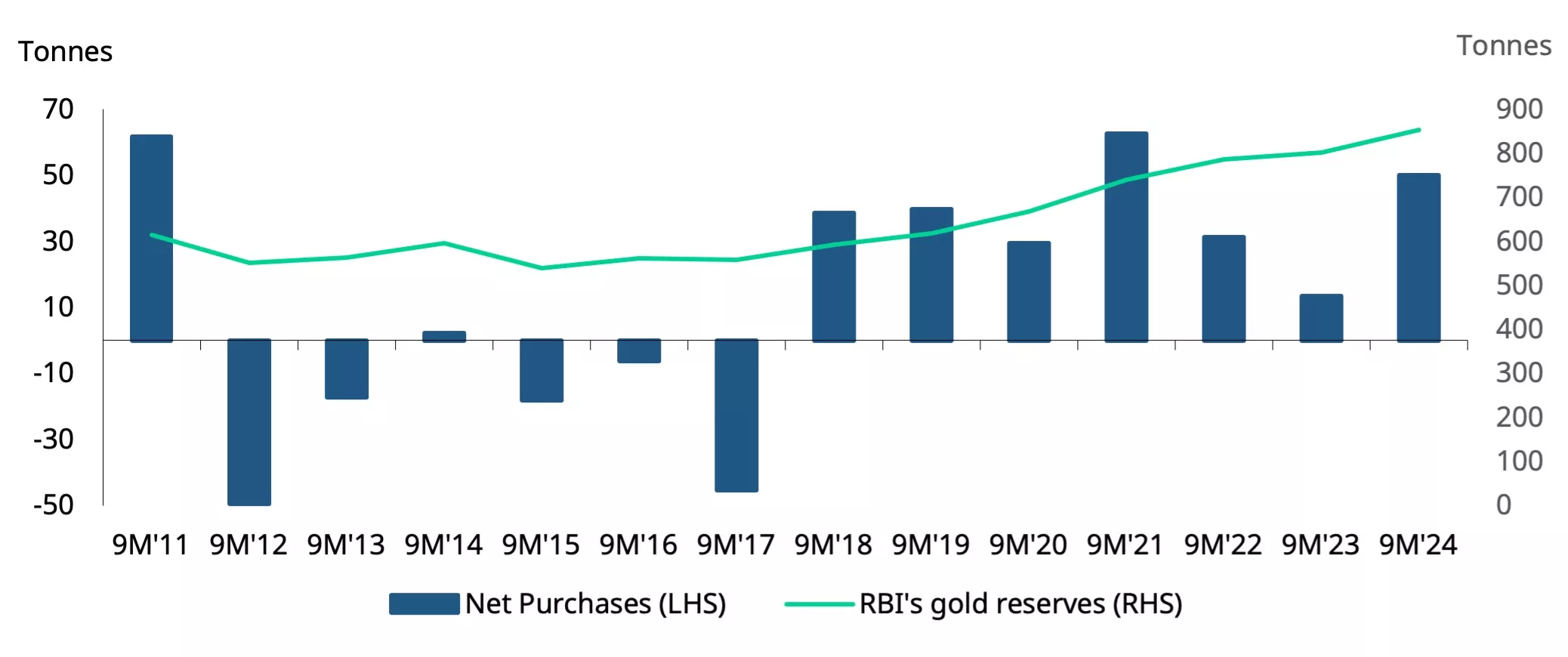

RBI’s strategic gold buying hits new highs

In an effort to diversify its forex reserves and to hedge against external uncertainties,8 the Reserve Bank of India has been strategically increasing its gold holdings. So far in 2024, the RBI has made substantial purchases, adding a total of 54.7t to its reserves since the end of 2023 - the highest acquisition in three years. This increase reflects a y-t-d rise of 6% in reserves, bringing the RBI’s total gold holdings to a record 858.3t, positioning it as one of the leading buyers of gold this year.

Chart 4: RBI's gold purchases reach three-year high in 2024

RBI’s net purchases and reserves; in tonnes*

*Data as of 4 October 2024.

Source: RBI, World Gold Council

Gold imports moderate

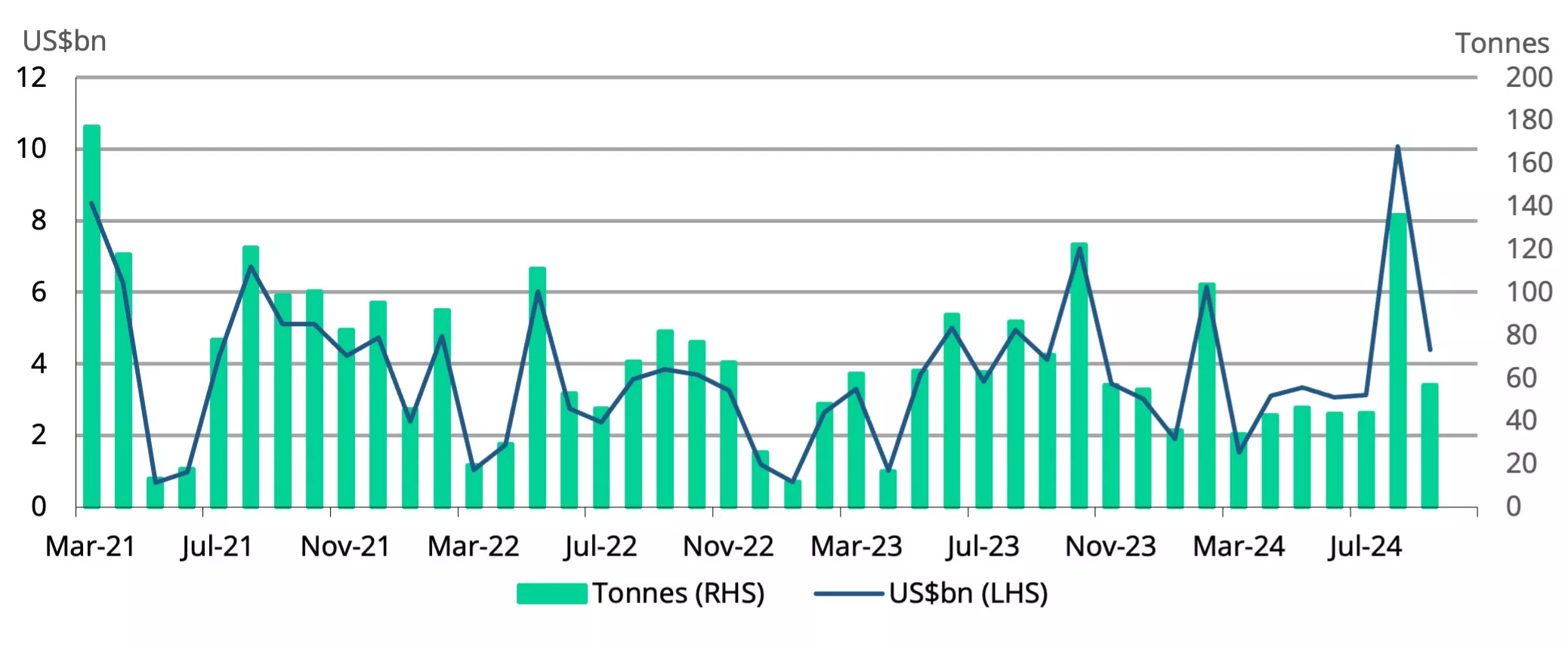

September saw a drop in gold imports from the unprecedented levels recorded in August. However, at US$ 4.4bn, imports remained significantly higher than the average of US$3.18bn during January to July. Our estimates indicate that in volume terms, imports for the month were around 55-57t, markedly lower than the 136t imported in August. This drop can be attributed to normalising demand and the substantial festival-related imports made by bullion dealers and manufacturers the previous month. From January to August, gold imports increased by 27% y/y, totaling US$37bn; in volume terms, the increase is estimated to be around 6%, approximately 540t.

Chart 5: Gold imports slowed in September

Monthly gold imports; in tonnes and US$bn*

*As of 16 October 2024. Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1 Landed price of gold is the international price adjusted for import taxes and exchange rate.

2 As of 4 October, 2024

3 Based on LBMA Gold Price AM.

4 Landed price

5 Hallmarked gold coins, bars see 35-80% sales surge on the e-commerce platforms, The Economic Times, 24 September 2024.

6 Premium or discount to international price is calculated as the difference between the landed price of gold (which is the international price adjusted for import taxes and exchange rate) and the domestic selling price.

7 January to September.

8 Buying gold annually to diversify allocation of forex reserves. The EconomicTimes, 19 June, 2024