India’s gold market update: Festive buying holds ground in the face of high prices

18 November, 2024

Published 18 November 2024, updated 17 December 2024.

Highlights

- Despite record-high prices Diwali gold demand was healthy, with strong sales driven by investment appeal

- Indian gold ETFs continue to attract strong interest from investors, with October seeing the largest inflows on record

- The Reserve Bank of India (RBI) has purchased 64t1 of gold to date this year, making it the third highest annual purchase on record

- Uptick in gold imports in October.

Looking ahead

- A price correction or stabilisation could stimulate demand after the peak festive season and during the upcoming wedding season from November to March

- Bullish sentiment is likely to sustain investment interest in gold amid ongoing volatility in equity markets.

Gold extended its record-breaking streak into October; momentum softens post US elections

Gold continued its rally in October for the fourth consecutive month, hitting multiple fresh highs and closing the month with a gain of almost 5%, at US$2,779/oz.2 The price rise was driven by event risk and uncertainty surrounding the US elections, along with escalating geopolitical tensions, which outweighed the higher opportunity cost for gold on account of a stronger US dollar and higher bond yields (see Let's tally the rally). The domestic gold price mirrored movements in the international price, although with a slightly higher gain due to the 0.2% depreciation of the Indian rupee (INR) and festive buying support. In the domestic market gold closed the month at INR79,683/10g,3 up 5.5% in the month.

The rally in gold paused post the US election as the dollar strengthened and Treasury yields rose. In fact, both international and domestic gold prices have fallen by 8% since the end of October. Despite this recent pullback, gold remains one of the best-performing assets this year, with a y-t-d return of 17% in INR terms at the time of publication.

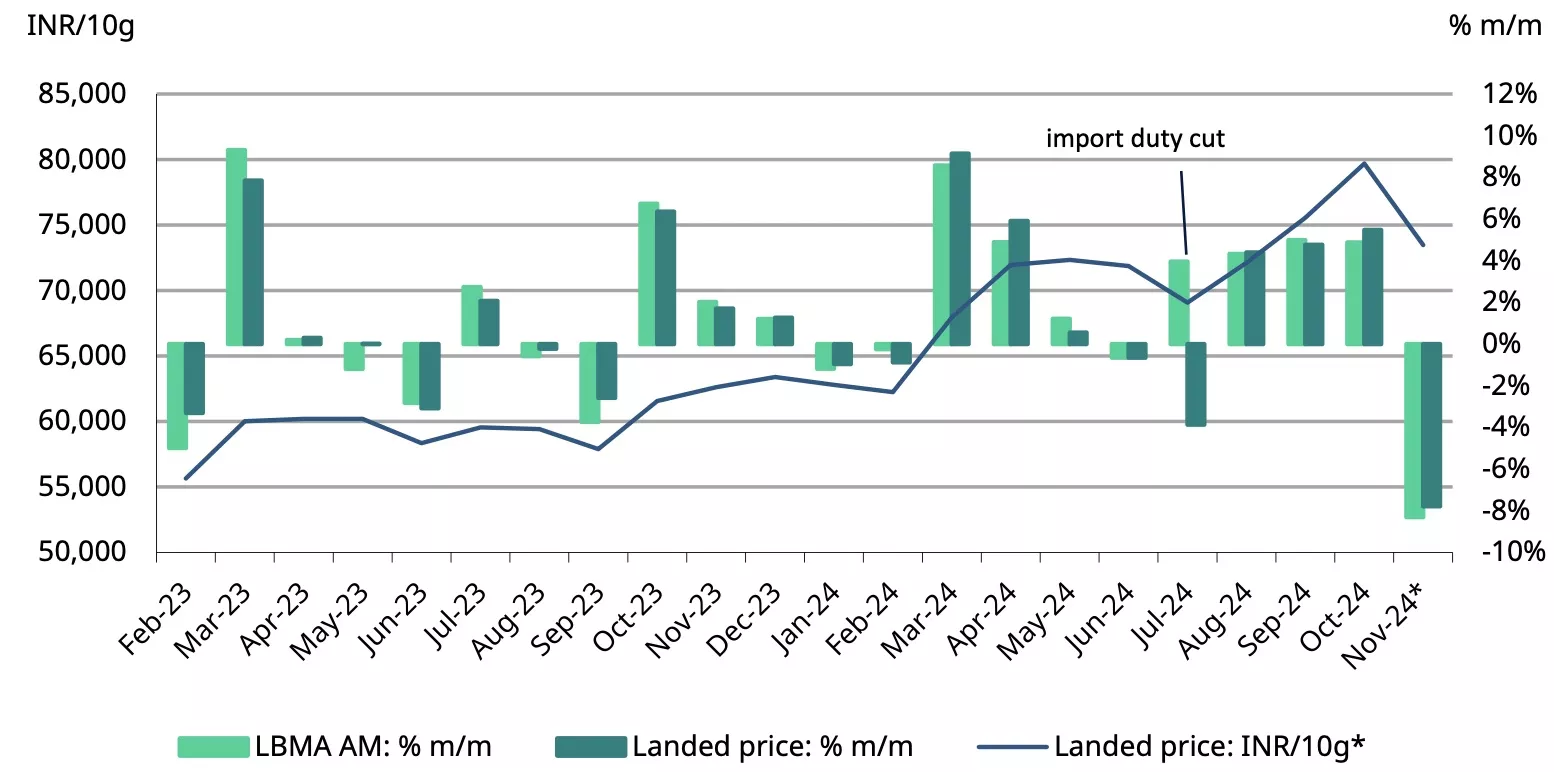

Chart 1: Gold’s climb slows after October gains

Monthly LBMA Price AM and domestic landed price* changes and movement

*Based on the LBMA Gold Price AM in USD expressed in local currency as of 14 November 2024. Landed price includes import tariff and tax.

Source: Bloomberg, World Gold Council

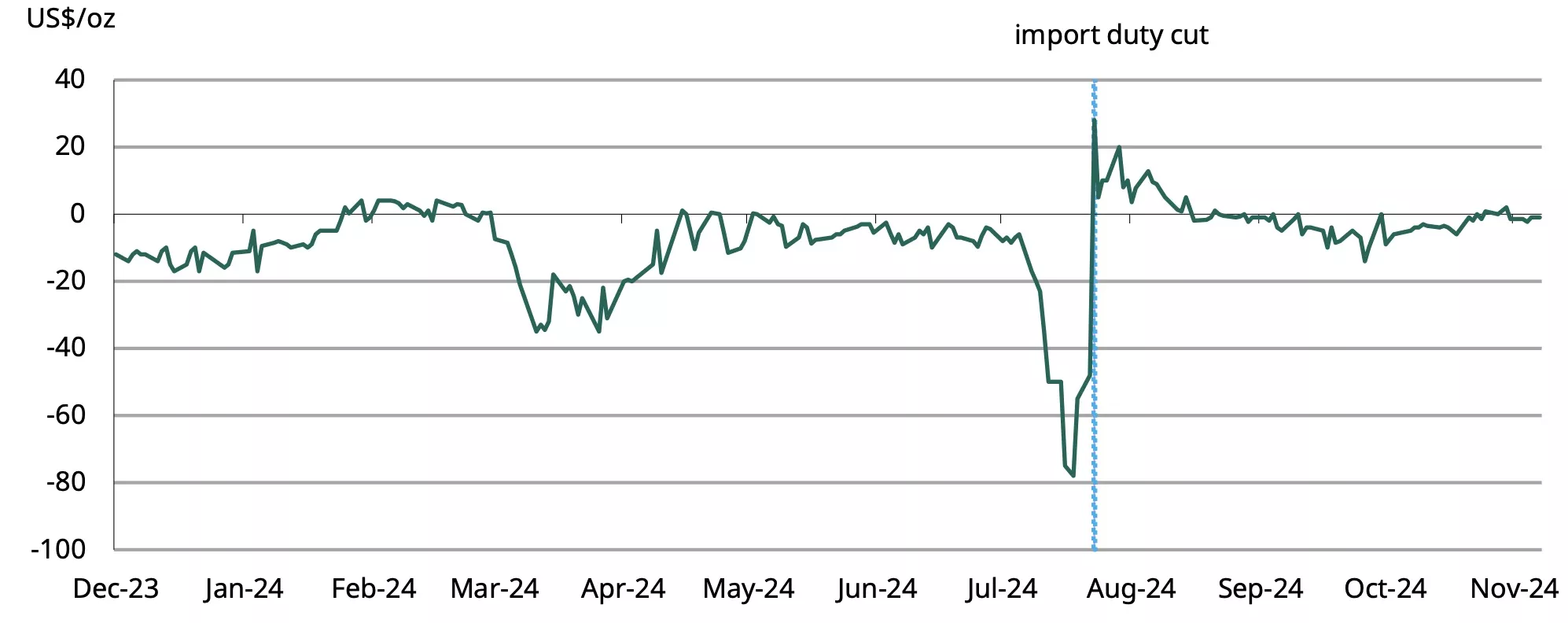

Gold in the domestic market has been trading at a slight discount to its international counterpart4 since mid-August, reflecting a balanced demand-supply dynamic. Following the sharp import duty cut in July, the flow of smuggled gold into the country has almost ceased, making way for official imports.

Domestic gold prices were at par with – or even at a slight premium to – the international prices around the peak festive period in late October, reflecting the higher level of demand. The average monthly discount narrowed from US$5/oz in September to US$2.8/oz in October, before tapering to US$1/oz in the first week of November.

Chart 2: Domestic gold prices trade at a marginal discount to international prices

NCDEX gold premium/discount relative to international price*

*As of 7 November 2024.

Source: NCDEX, World Gold Council

Festive auspicious buying and bullish sentiment support gold demand

Despite record high prices, consumer buying during Diwali was strong in both gold jewellery and bars and coins.5 Markets and media reported higher footfall at jewellery stores and robust buying of coins via online as well as offline platforms. Promotional events and marketing campaigns undertaken by jewellers to lift sales.6 The price increase since Diwali 2023, has enhanced consumer sentiment, positioning it as a long-term investment. And volatility in domestic equity markets, coupled with rising international prices, has added to gold’s investment appeal. Anecdotal reports suggest that auspicious ‘token’ purchases were rather broad-based, spanning regions and demographics.

Despite a y/y drop in the volume of gold sold,7 the value of sales increased, driven by the higher price.

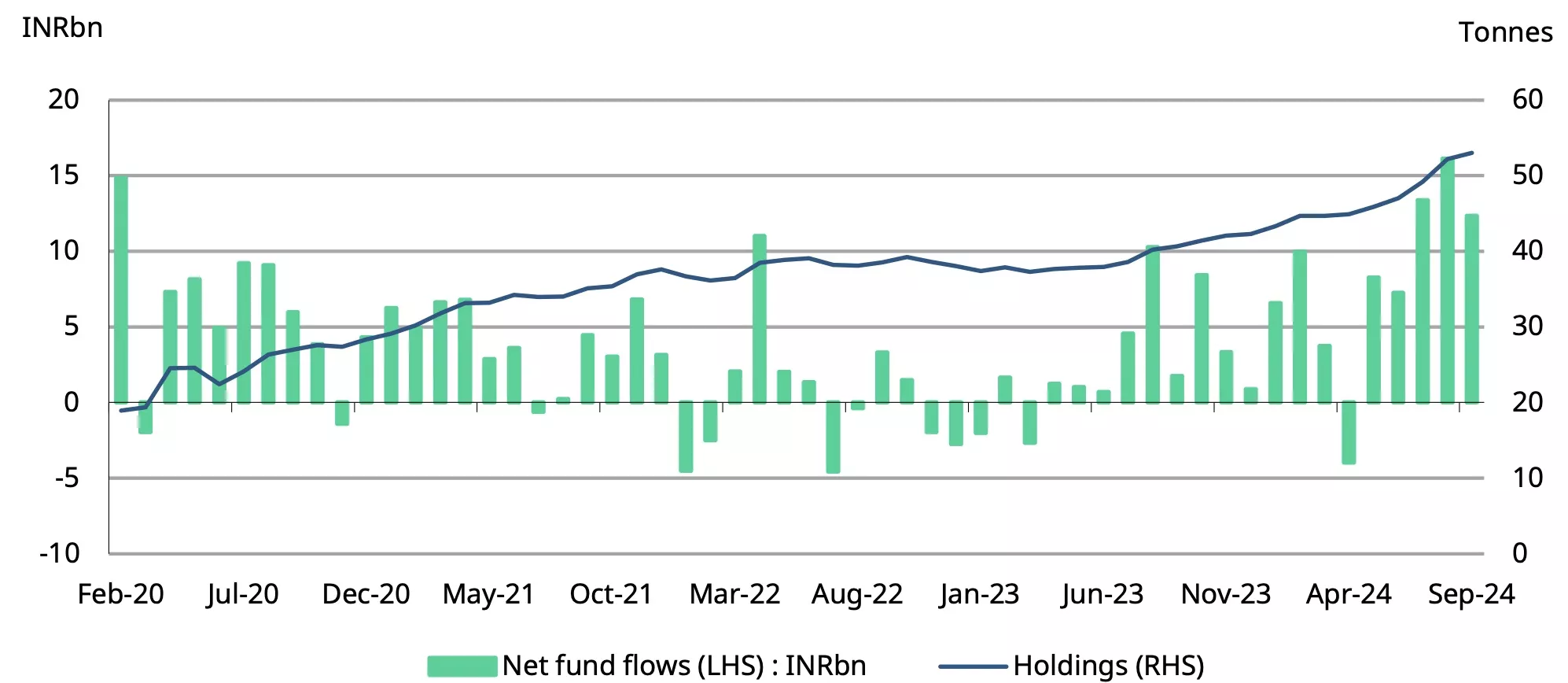

Consistent demand for gold ETFs

Indian gold ETFs continued to attract strong inflows in October, fuelled by a favourable gold price momentum and increased volatility in domestic stock markets. The long-term capital gains treatment for gold, which was announced in July, has provided a continued boost, as reflected in the significant rise in inflows since that time.

From July to October monthly average net inflows into Indian gold ETFs reached INR15.4bn/US$183mn, a significant increase from the average of INR5.3bn (~US$63mn) in the first half of the year. According to the Association of Mutual Funds in India (AMFI), October saw record net inflows of INR19.6bn (~US$233mn), pushing the total assets under management (AUM) for Indian gold ETFs to a new high of INR445bn(~US$5.3bn). This represented a 12% m/m and a 70% y/y increase. Over the first 10 months of 2024 total net inflows into Indian gold ETFs reached INR93bn(~US$1.11bn), a substantial rise from INR25bn($301mn) during the same period last year. These funds have collectively added 12.2t of gold to date in 2024, bringing their total gold holdings to 54.5t and representing a 32% y/y growth.

Chart 3: Record inflows boost cumulative gold holdings

Monthly gold ETF fund flows in INRbn and total holdings in tonnes*

*As of end October 2024.

Source: Bloomberg, company filings, AMFI, CMIE, World Gold Council

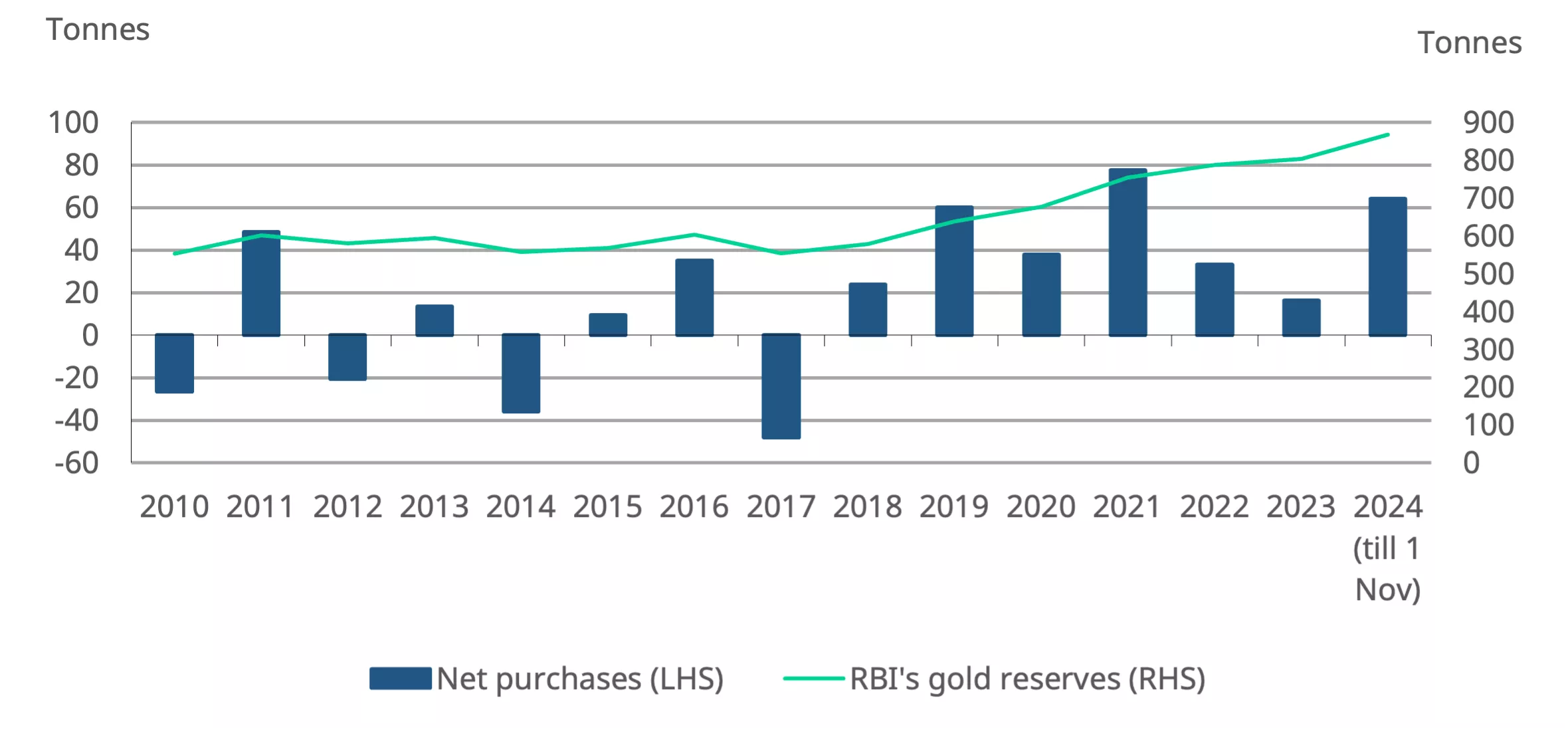

Sizeable addition to the RBI’s gold reserves in October

The RBI made significant gold purchases in October, boosting its total reserves by 8% y-t-d to 868t. According to RBI data8 and our own estimates, around 14t of gold was added to the central bank’s foreign exchange reserves in the month, bringing total gold y-t-d purchases to 64t.9 This makes it the third-highest annual net gold purchase by the RBI, after the 257t purchased in 2009 and 77t in 2021. In value terms, gold now accounts for 10% of total foreign exchange reserves, the highest share since 1999.

Alongside this expansion the RBI has focused on holding its gold reserves domestically10 and has reduced the amount kept in safekeeping with the Bank of England and the Bank for International Settlements (BIS). As of end-September 2024, 60% of the RBI’s total gold reserves – equivalent to 510t – were held domestically, an increase of 102t since March 2024. This marks a significant rise from the 38% held in domestic storage in March 2023.

Chart 4: RBI's gold stock hits historic highs

RBI’s net purchases and reserves, in tonnes*

*Data as of 1 November 2024.

Source: RBI, World Gold Council

Imports rise amid seasonal demand

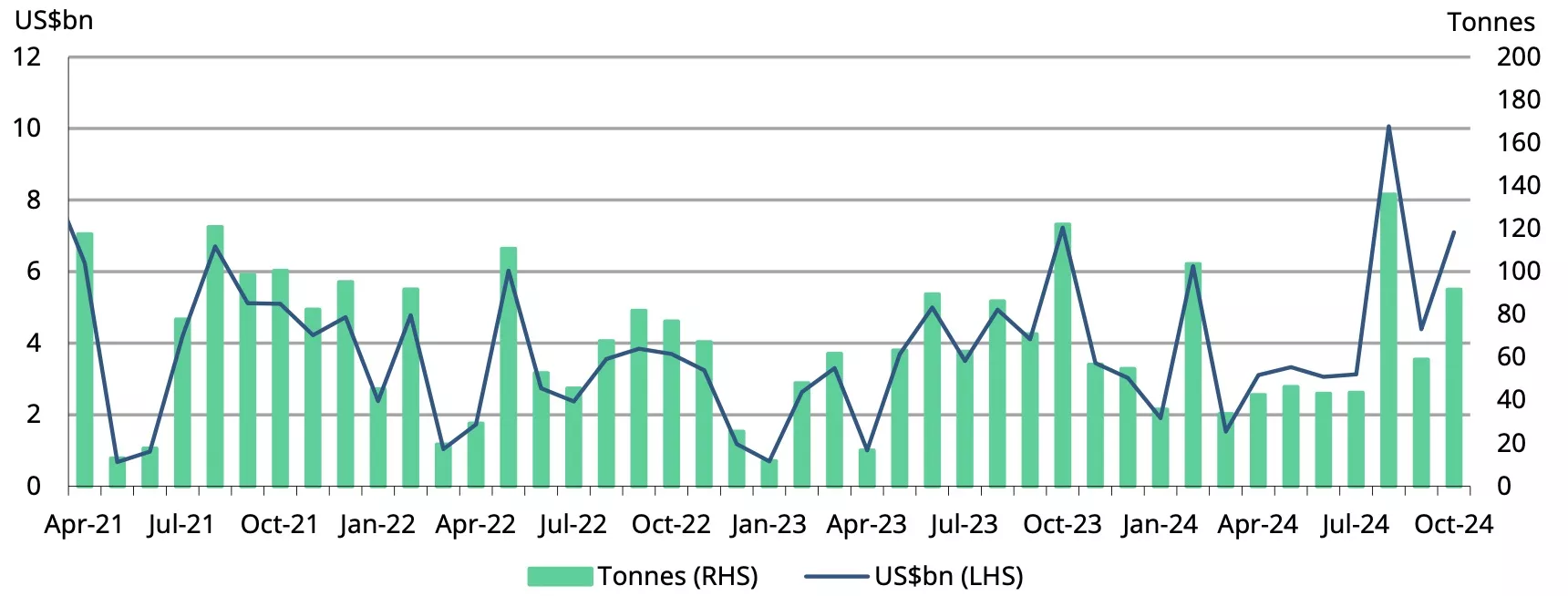

In October, gold imports rose to $7.13bn from $4.39bn in the previous month, reflecting the seasonal uptick in demand for festivals and weddings. Our estimates indicate that the volume of imports was approximately 90-92t, higher than the 59t imported in September. Since the reduction in import duties in July, monthly imports have averaged around 95t, up from 50t earlier in the year. Year-to-date, gold imports have grown by 21%, totaling $44bn, with volumes remaining steady at around 635t.

Chart 5: Gold imports expand

Monthly gold imports; in tonnes and US$bn*

*As of 14 November2024. Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1As of 1 November 2024.

2Based on LBMA Gold Price AM.

3Landed price.

4Premium or discount to international price is calculated as the difference between the landed price of gold (which is the international price adjusted for import taxes and exchange rate) and the domestic selling price.

5Dhanteras demand trumps metal price hike, The Telegraph, 8 November 2024.

6Jewellery firms cut making charges, weight to lift sales, The Mint, 23 October 2024.

7As prices jumps, gold buyers keep it light this Dhanteras, The Economic Times, 30 October 2024.

8Forex reserve data in the Weekly Statistical Supplement. This blog was updated on 17 December 2024 to reflect the correct increase in gold reserves (in tonnage terms) in November and year-to-date.

9Up until 1 November 2024.

10Half Yearly Report on Management of Foreign Exchange Reserves: April - September 2024.