India gold market update: Gold outpaces other asset classes

17 January, 2025

Highlights

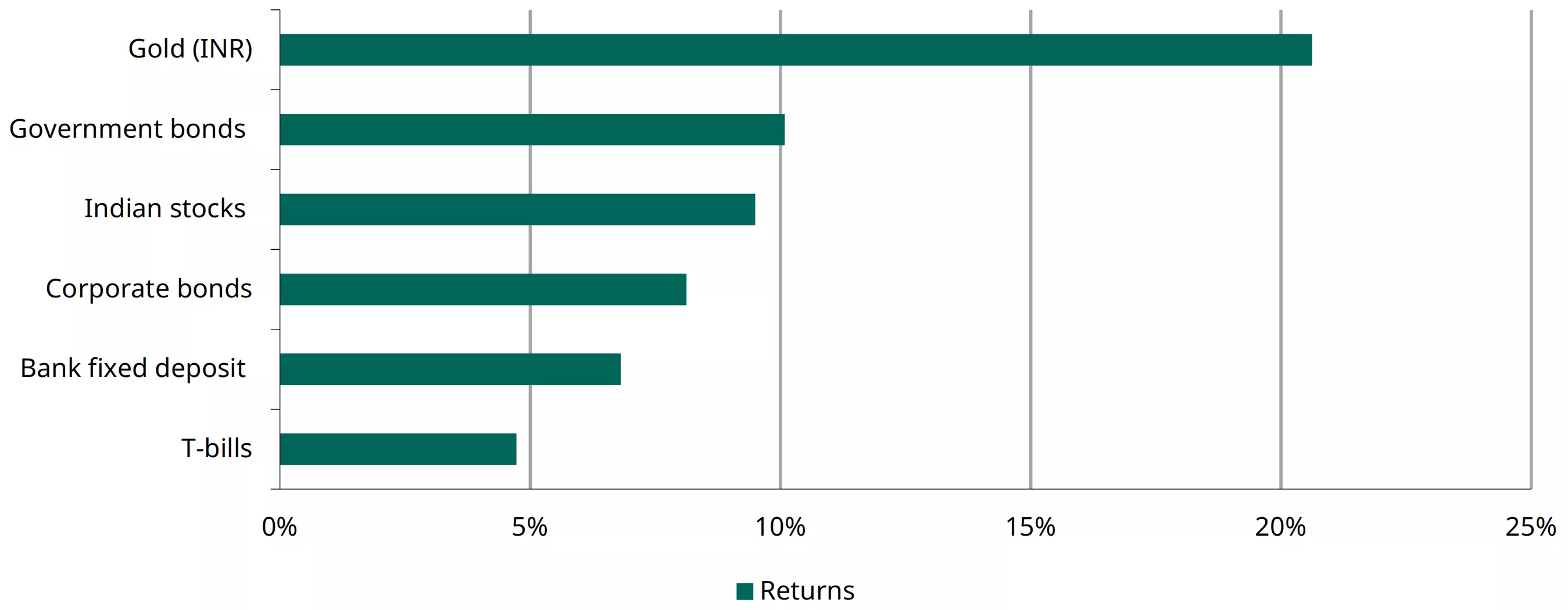

- Even with a price moderation in November and December, gold surpasses other key asset classes to lead returns in 2024

- Jewellery demand slowed amid high prices and an inauspicious period on the Hindu calendar

- Indian gold ETF momentum slows in December, but 2024 sees record annual inflows

- The Reserve Bank of India (RBI) accumulated 72.6t of gold in 2024, ending the year with 876t in reserves

- Annual gold imports remained relatively stable after an 82t downward revision in the April to October import figures.

Looking ahead

- Jewellery demand is expected to gradually recovery from mid-January, primarily driven by wedding purchases. Demand, however, will be favourably influenced by gold price stability. The recent trend in investment demand is expected to continue.

Gold ends 2024 as the best performing asset

Despite a price moderation in November and December, gold emerged as the top-performing asset class in India, posting y/y gains of 21%1 in 2024. However, gold’s return in INR was lower than its 26% return in USD terms.2

In December gold extended the decline: dropping 2% after a 4% decrease in November and closing at US$2,610/oz. This decline can largely be attributed to the strong rally in the US dollar. Limiting the slide were a persistent and growing geopolitical risk, and a positive trend in global gold ETF flows. In the domestic market, amid price fluctuations, gold closed December 0.4% lower at INR76,328/10g.

Gold has started 2025 on a strong note, rising 2.7% to US$2,679/oz as of 10 January, partly recouping the loses of the previous two months. Global uncertainties continue to support prices. There has been a similar increase in INR terms too (to INR78,360/10g).

Chart 1: Gold outshone nearly every major Indian asset class in 2024

% y/y returns in INR *

*As of 31 December 2024. Indices used: MCX Gold Index, CRISIL Corporate Bond Index, S&P BSE Sensex Total Return Index, Clearing Corp of India Liquidity Weight T-Bill Index, ICE BofA Govt Bond Index.

Source: Bloomberg, World Gold Council.

Subdued jewellery demand since December

Consumers have been hesitant about buying gold jewellery due to high and fluctuating prices and the inauspicious period in the Hindu calendar, which runs from mid-December to mid-January. Buying has primarily been wedding-related. But anecdotal market reports tell us that physical investment demand for bars and coins has been sustained, emphasising gold’s investment appeal.

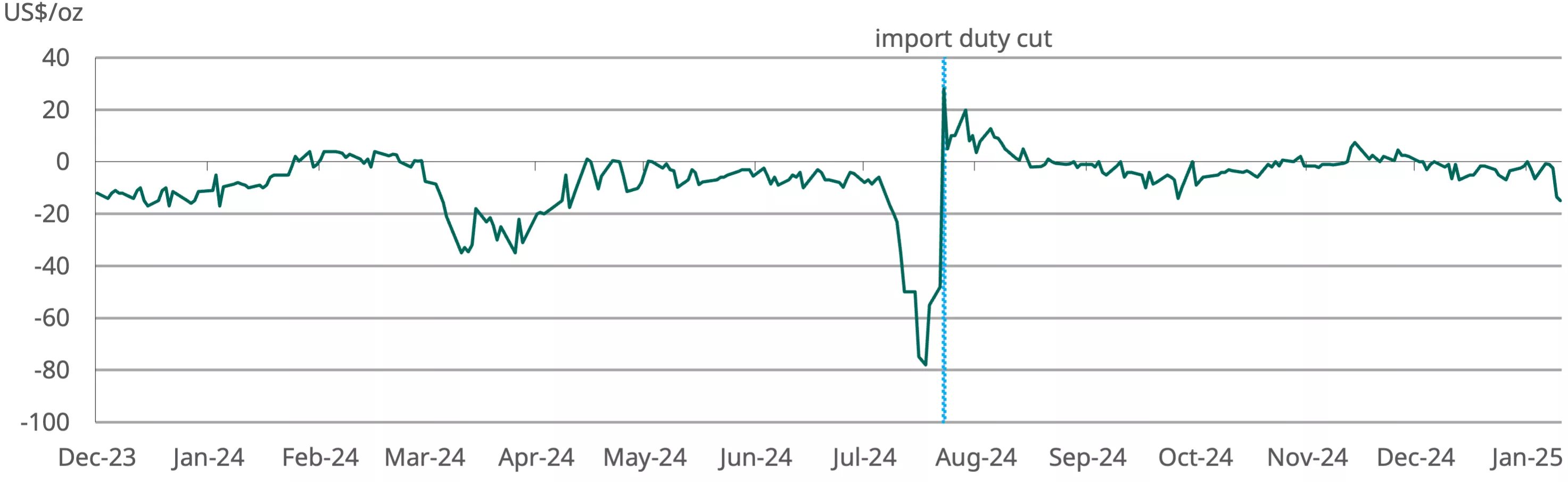

The subdued demand environment was reflected in the spread between domestic prices and international prices. Since December domestic gold prices3 have traded at a discount to international prices; discounts averaged US$4/oz and have recently widened to US$15/oz.4

Chart 2: Domestic gold prices are trading below international prices

NCDEX gold premium/discount relative to international price*

*As of 10 January 2025.

Source: NCDEX

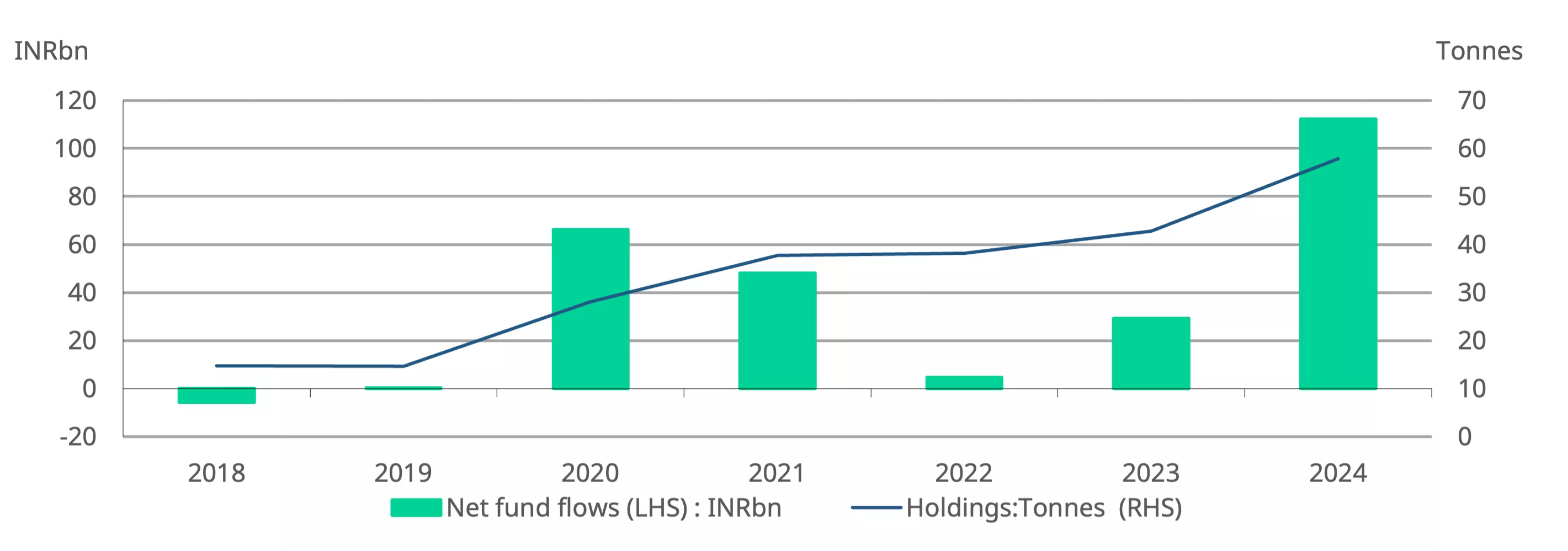

Gold ETFs maintain positive flows, though momentum slows in December

Indian gold ETFs experienced their eighth consecutive month of net inflows in December, although at their lowest level since June 2024. The decline in gold prices during the month likely impacted the momentum seen previously. However, ongoing volatility in equity markets, coupled with the general bullish sentiments surrounding gold, continued to support investor demand. According to the Association of Mutual Funds in India (AMFI), gold ETFs recorded net inflows of INR6.4bn (~US$75mn) in December, reflecting a nearly 50% decline from the previous month and 32% lower than the average monthly inflows of INR9.4bn (~US$112mn) for the year. These figures are close to our initial estimates, which were based on information available at the time.5

Investor demand for gold ETFs surged in 2024, attracting net inflows of INR112bn (US$1.3bn), the strongest annual inflow on record and nearly four times higher than the previous year. Assets under management (AUM) grew by 63% y/y, reaching INR446bn (~US$5.2 bn). In total, 15t were added to gold holdings during the year, bringing the collective holdings to 57.8t and marking a 35% y/y increase. Furthermore, three new gold ETFs were launched in India during the year, bringing the total number of physically-backed funds available in the local market to 18.

The strong momentum in gold prices, global uncertainties, favourable tax revisions in the Union Budget in July, volatility in domestic equity markets, and the inherent transparency, liquidity and ease of transactions have collectively driven investor interest towards ETFs. A spike in inflows into multi-asset funds,6 which invest in gold ETFs, has been a contributing factor. These funds saw their net inflows nearly double to INR425bn (~US$5.1bn), with the market value of their gold ETF investment increasing by 97% y/y.

Chart 3: Growth surge in gold ETFs

Monthly gold ETF fund flows in INRbn, and total holdings in tonnes*

*As of end December 2024.

Source: Company filings, AMFI, CMIE, World Gold Council

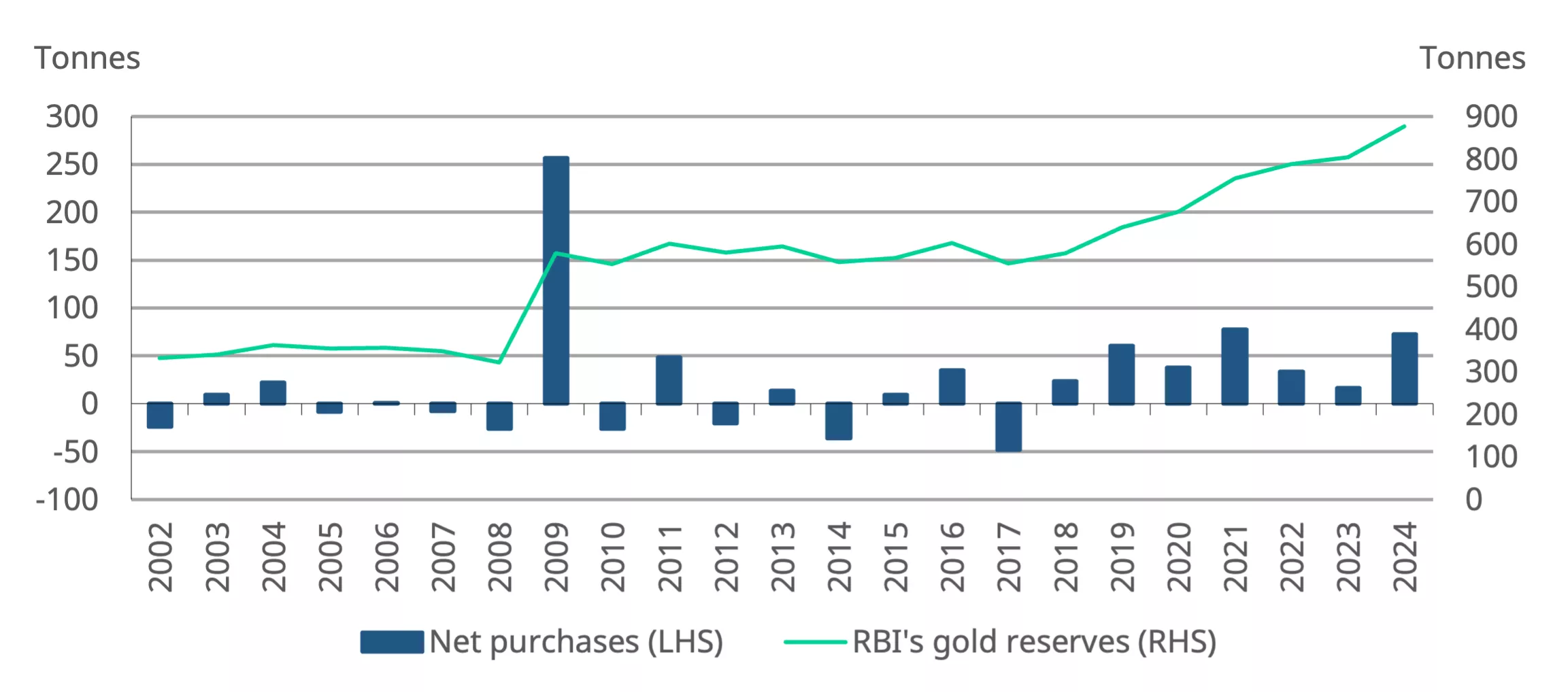

RBI pauses gold purchases in December but annual buying is significant

After 11 months of purchases the RBI paused its gold buying in December, accumulating 72.6t in 2024 and bringing its reserves to 876t. Nearly one-third of its gold purchases occurred in October and November (23t). The 2024 acquisition marks a significant increase on the 16.2t bought in 2023 and ranks as the third highest annual purchase since 2001. The RBI was the second largest buyer of gold among central banks in the first 11 months of 2024. Gold now makes up 10.6%7 of the RBI forex reserves, a noteworthy rise from 7.7% a year ago. This increased share highlights the RBI’s efforts to diversify its forex reserves into various assets, particularly gold, which is seen as a hedge against external uncertainties and challenges.8 2024 marks the seventh consecutive year that the RBI has been a net buyer of gold.

Chart 4: RBI’s 2024 gold purchase ranks as third highest annual acquisition

RBI’s net purchases and reserves, in tonnes*

*Data as of 3 January 2025.

Source: RBI, World Gold Council

Gold imports see downward revision, annual imports steady

There has been a significant downward revision in the gold import data published by the Ministry of Commerce for the period from April to November 2024; the revision has been attributed to double counting during the migration of data between two platforms.9

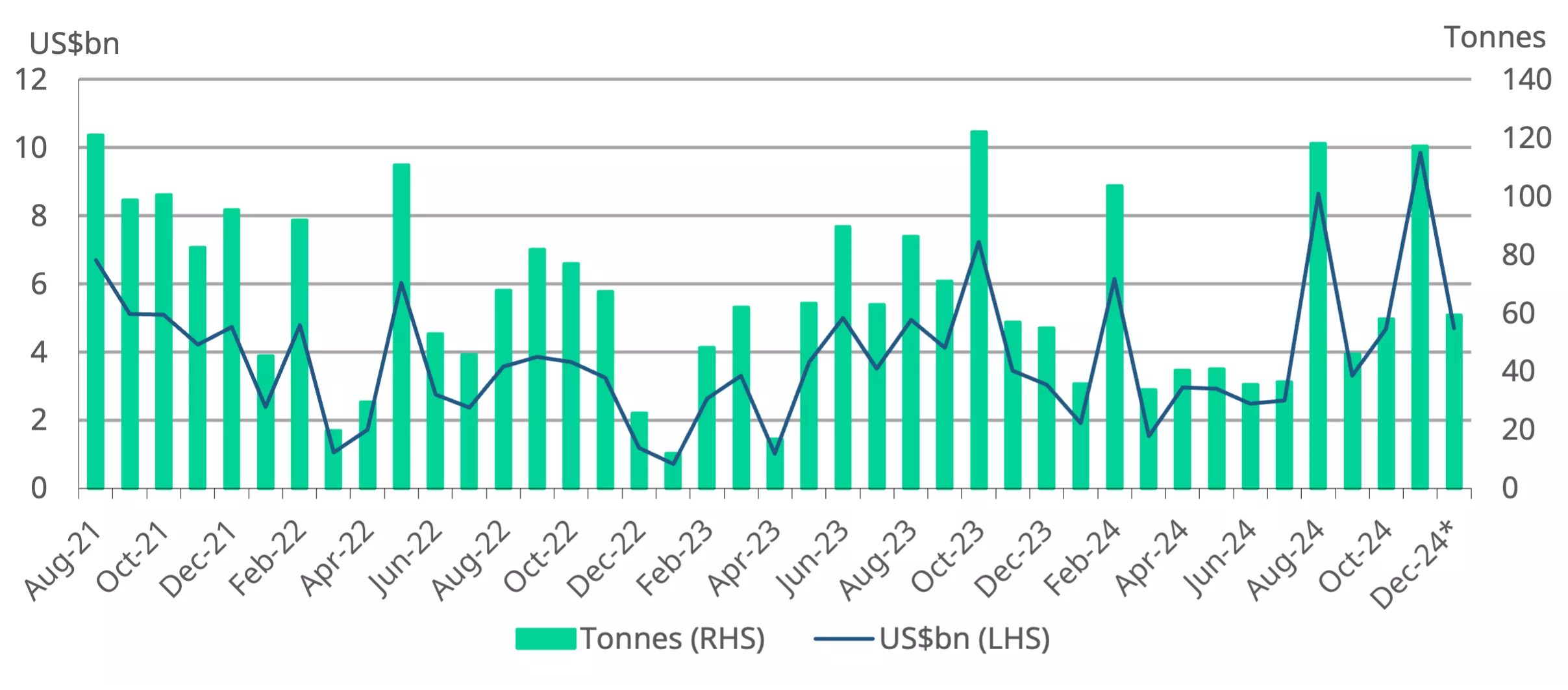

According to Ministry of Commerce data, from April to October the total quantity of gold imported has been revised down by 82t. These revisions ranged from 2t to 28t per month, with adjustments becoming more pronounced from August 2024. In value terms the imports from April to November saw a total correction of US$12bn. The sharpest revision – of US$5bn – occurred in November, although imports remained sizeable that month at 117t. Imports in December amounted to US$4.7bn, which in volume terms we estimate to be in the range of 55-60t.

Overall, the volume of gold imported in 2024 was slightly lower than the previous year, although the value of these imports increased by 21% to US$52bn, reflecting the gold price. Based on the latest available data we estimate the total import volumes for the year to be approximately 724t compared with 744t in 2023.

Chart 5: Gold import volumes were marginally lower in 2024

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1Based on the landed price of gold (international prices adjusted for import taxes and exchange rate).

2LBMA Gold Price PM.

3Domestic gold prices refer to the landed prices, which are the international prices adjusted for import taxes and exchange rate.

4As of 10 January, 2025.

5The daily AUM and NAV data published by AMFI covers 15 of the country’s 18 gold ETFs.

6Multi-asset funds are funds that must invest at least 10% in three broad asset classes across equities, debt and other (which includes commodities such as gold, REITs, etc).

7As of 3 January 2025.

8Buying gold annually in order to diversify allocation of forex reserves: Shaktikanta Das, Economic Times, 19 June 2024.

9Ministry of Commerce and Industry revises trade data after reconciliation, PIB, 9 January 2024.