In our view, any model that fails to account for economic growth alongside financial factors will prove insufficient in establishing gold’s long-term expected return.

Our novel contribution highlights the theoretical and empirical importance of economic growth and gold’s role in global portfolios in driving gold prices in the long run.

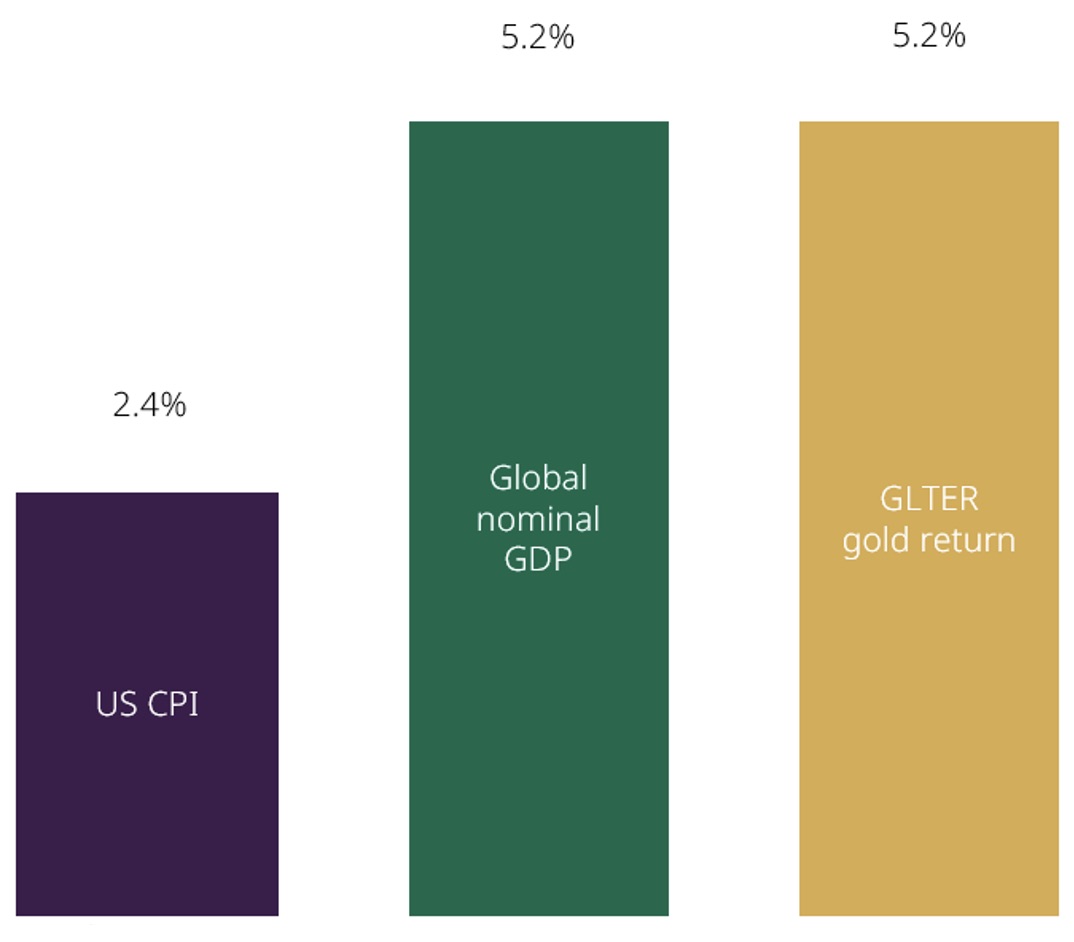

GLTER complements our other gold pricing models, GRAM and Qaurum, where economic expansion is present but not a central driver given their short- and medium-term focus. And it explains why gold’s long-term return has been and will likely remain, well above inflation.1